When it comes to planning for the future, considering life insurance is essential. Very often life insurance is a key building block to success and peace of mind for a client.

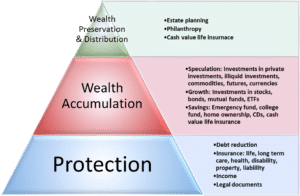

In the Mindful Finance financial planning pyramid of needs (see below), life insurance is a topic for consideration across all levels of the pyramid. This is due to the fact that life insurance has many different applications.

The base level of the pyramid is Protection.

This refers to those things that create financial stability in your life. Life insurance is a very important consideration at this level. There is usually a place for life insurance in a financial plan when there are dependents who would need money in the event of another person’s death.

Common life occurrences that give rise to the need for life insurance for protection include: marriage, the birth of a child, homeownership, the presence of adult dependents, and college planning. In these circumstances many different types of life insurance may apply.

An inexpensive term life insurance policy for the time period of the risk may work perfectly for protective purposes. In some cases, it may make sense to look at a cash value life insurance policy. This is often the case when the length of time for which the coverage is needed is long or indefinite. As well, there are life insurance policies which can also offer long term care insurance options. The flexibility of life insurance makes it an essential consideration at the Protection level of financial planning.

As we move up the pyramid to Wealth Accumulation, insurance shows up again.

At this level the protective need for life insurance may still be a consideration, but there is also the added goal of building your wealth. In this case, a cash value life insurance policy is worth considering.

Within the Wealth Accumulation level of the pyramid, cash value life insurance typically fits in at the safe/stable end of the spectrum. These policies have very low risk and can slowly build very large cash values. The cash value can be used by the policy owner during their lifetime. In this way, a cash value life insurance policy functions as a method of both protection and wealth accumulation.

Here are a few notable facts about how cash value life insurance works:

- The policy has two values, the death benefit and the cash value.

- The cash value increases every year, it doesn’t go down (unless you choose to reduce it).

- Eventually the cash value grows to be more than the amount of premiums paid, leading to the “investment return”.

- The cash value can be accessed tax free through a policy loan.

- Insurance is one of the safest places to put money. The insurance company guarantees the policy values.

At the top of the pyramid is Wealth Preservation & Distribution.

At this level life insurance comes into play for estate planning purposes. Here life insurance is primarily considered for its valuable tax planning and wealth transfer properties. Insurance use for business succession can also be a consideration in this type of planning.

Prudent planning and the use of cash value life insurance can help people with large estates reduce the size of their estate, and provide funding for estate taxes. This type of planning may involve the use of an irrevocable life insurance trust.

Liquidity from a life insurance policy can also help to mitigate many issues that arise from a lack of readily available cash in an estate. If you have valuable real estate, business, or farm assets you may be at particular of leaving adverse tax consequences to your heirs, along with these assets. In these cases life insurance may be of great benefit if it is structured to offset these risks.

In general cash value life insurance is an underused tool for Wealth Accumulation and Wealth Preservation & Distribution. Most often people are simply unaware of the benefits available to them.

In particular, people don’t know how the cash value aspect works, and so think of insurance as an expense rather than an asset. Another possibility is that a slow, safe, long-term growth holding does not sound as appealing as stocks or other options with more upside potential. We think people should understand how cash value works, and see if the long-term thinking of whole life insurance appeals to them.

Life insurance is very flexible and can be used to fit many different needs and circumstances. From low-cost term life insurance to high premium, overfunded cash value life insurance there are many options that should be considered by anyone interested in financial planning for their goals.